Looking to invest in the next big thing before it becomes, well, the next big thing? Imagine if you had put your money into Amazon at the start of the e-commerce revolution. Or into Tesla before electric vehicles took off. That’s the goal of thematic investing: ride the major trends shaping our world. Think AI, renewable energy, or the aging population — mega-trends that cut across industries, leading to both disruption and new opportunity.

Now you might be thinking, “Okay, but how do I spot these trends? And once I do, can I even invest in them?” Don’t worry – it’s not as complex as it might sound. With a thriving ecosystem of thematic ETFs and emerging tech stocks, it’s not hard for individual investors to bet on the themes they believe in. But don’t go throwing your money at every futuristic concept that catches your eye.

Not all trends are created equal, and timing can be everything. By the time an idea catches mainstream attention (in the evening news, for example), it’s often too late. So the key to successful thematic investing is building an information advantage and staying ahead of the curve.

Thematic Investing Explained

So what exactly is thematic investing, and is it for you? Well, think of it like this: traditional investing is like betting on which horse will win the race. Thematic investing is like betting on the future of transportation itself. Will we all be driving flying cars in 20 years? If you believe so, you might invest in companies working on that technology.

Now why should you consider this approach? First, it’s got serious return potential. If you correctly identify a major trend early on, you could be in for impressive multiples that are hard to find with other investment strategies. Just ask early investors in e-commerce (e.g. Amazon) or AI (e.g. Nvidia). The leaderboards of any generation are often dominated by the investors who picked the right themes.

But it’s not just about the money. Sometimes it’s just about sending a message. Thematic investing allows you to align your portfolio with your values and vision of the future. Passionate about combating climate change? There are themes for that. Believe in the power of genomics to revolutionize healthcare? There’s a theme for that too.

Finally, thematic investing makes the abstract world of finance feel tangible and relevant. This makes it a great strategy for stock market beginners. When you invest in a theme, you can see it playing out in the world around you. There’s also a huge thrill of watching a fledgling theme (that YOU believed in early) grow into a sweeping force that dominates the mainstream discussion. While the pundits debate the future of XYZ and argue about its pros and cons, your pockets are already being filled.

Of course, like any investment strategy, thematic investing isn’t without its risks. Trends can fizzle out, timing can be tricky, and hype doesn’t always translate to returns. But if you enjoy thinking about the future and taking a long-term view, thematic investing can be hugely rewarding.

Thematic ETFs vs. Individual Stocks

Once you’ve found a theme that you believe in, the next step is to invest in it. For that, you have two main options: ETFs or individual stocks. If you’re a beginner or just looking to add a bit of thematic exposure to your broader portfolio, then ETFs are a good place to start. But if you’re looking to make thematic investing your “main” strategy, you’ll eventually want to learn how to evaluate individual stocks.

Note that it’s not an all-or-nothing choice. Many thematic investors use both ETFs and individual stocks, to gain both diversification and more focused bets on their highest conviction ideas.

Thematic ETFs: Easy, But Limited Upside

Thematic ETFs are a pre-packaged basket of stocks related to a specific theme. They’re a nice starting point because you’ll get instant diversification within a theme. It’s much less time-intensive for you because ETFs are professionally managed (someone else picks the stocks). You can search for and compare ETFs on platforms like ETF Database or ETF.com.

The downside of ETFs is that they limit your potential upside. You have no control over which individual stocks go into the ETF, and the professional management comes with higher fees. But that’s not even the biggest problem with ETFs… the biggest problem with ETFs is that they are often jam packed with companies that are only tangentially related to a theme.

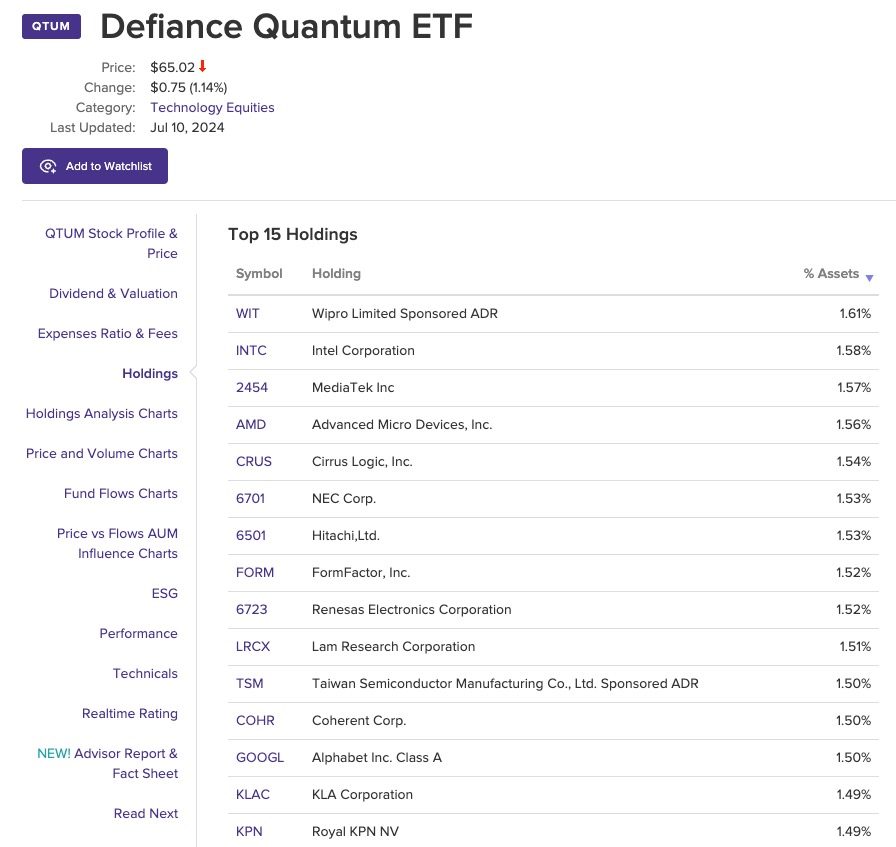

Take the Defiance Quantum ETF for example. This ETF is meant to give investors exposure to quantum computing and next-gen AI. But just take a look at what you’re actually getting:

Most of these companies are either large tech giants (e.g. Intel, AMD, and Alphabet) with a negligible amount of their existing business being related to quantum computing… Or they’re barely related to quantum computing at all (e.g. Wipro is mainly an Indian IT and consulting company). Meanwhile, guess what’s missing from this list? Actual pure-play quantum computer makers.

Now, it might seem like we’re picking on the Defiance ETF, but we’re not. The ETF might still perform well overall, but if your goal is to really bet on the rise of quantum computing, just know that your exposure will get diluted by a substantial amount.

We’re also not trying to rant against ETFs as a whole. They have their time and place, especially with the easy diversification they allow. The point is that, if you’re determined to become a master at thematic investing, you’re going to outgrow ETFs sooner or later. Just be prepared for that.

Individual Stocks: The Precision Play

Once you outgrow ETFs (or if you’re bold enough to start here), picking individual “pure-play” stocks is the name of the game for thematic investing. For example, if you wanted to bet on the rise of AI back in 2016, you really wanted Nvidia above all else. And while diversification is certainly important, thematic investors who had strong convictions in Nvidia made out like bandits.

Fortunately, finding suitable individual stocks is actually not as hard as it might sound. Why? Because for a thematic investor, there are actually only a handful or fewer “pure-play” stocks for emerging themes.

For example, at the start of the recent EV boom (circa 2019), there was really only one major EV automaker in America: Tesla (TSLA). You had some Chinese companies too, but if you specifically wanted to bet on the US electric vehicle market, your options were basically Tesla or a few indirect plays (such as battery suppliers). Other EV companies like Rivian (RIVN) or Lucid Motors (LCID) didn’t go public until 2021, after EV hype had reached its peak.

In other words, if you were an early believer in the future of EVs, you would’ve bought Tesla. And you would’ve been massively rewarded for that decision. At the end of 2019, Tesla was trading for under $30 per share (adjusted for its later stock split). By the time Rivian had gone public in 2021, Tesla’s price had shot up to about $355 per share. A whopping 1080% return on investment? Yes please!

Of course, picking individual stocks is riskier and harder than just “settling” for an ETF. All your eggs are in fewer baskets, and the research process can be much more time-intensive. You’ll also need to study each theme in much more depth to truly see the truths that others cannot.

Major Themes in 2024: A Sample

Now that we’ve covered the basics, let’s explore some of the major themes that are relevant today. Keep in mind that this list is merely a sample – an appetizer. Each of these themes deserves its own guide, and each has its own sub-themes as well. This is just to illustrate some of the directions you could go with thematic investing:

Artificial Intelligence (AI)

Unless you’ve been living under a rock, you’ve probably heard about the AI boom. From ChatGPT to self-driving cars, AI is making waves across industries. But here’s the million-dollar question: Is this the real deal, or just another hype cycle?

Some investors see AI as the next industrial revolution, potentially transforming everything from healthcare diagnostics to financial services. Others worry it’s overhyped and that many “AI companies” really don’t need to use AI at all. Your job as a thematic investor? Figure out which side you’re on and invest accordingly.

Key Arguments for Investing in Artificial Intelligence

- AI is becoming a general-purpose technology like electricity, potentially boosting productivity across all sectors.

- The emergence of foundation models (like GPT) is democratizing AI development, allowing smaller companies to build powerful AI applications without massive R&D budgets.

- AI is starting to make breakthroughs in scientific research, like AlphaFold’s protein structure predictions, potentially accelerating drug discovery and materials science exponentially.

Climate Tech

With extreme weather events making headlines and governments worldwide pushing for net-zero emissions, climate technology is a theme that’s hard to ignore. This isn’t just about solar panels and wind turbines anymore. Think carbon capture, energy-efficient buildings, and even lab-grown meat.

The big debate here? How quickly will the world transition to cleaner technologies, and which solutions will win out? Your answer could guide your investments in this space.

Key Arguments for Investing in Climate Tech

- The cost of renewable energy has dropped below fossil fuels in many areas, making green energy economically superior even without subsidies.

- Climate change is creating new markets, like carbon capture and storage, which could become a trillion-dollar industry as countries strive to meet net-zero targets.

- Extreme weather events are forcing rapid adaptation, driving innovation in areas like flood-resistant infrastructure and heat-tolerant agriculture.

Genomics and Personalized Medicine

Remember the Human Genome Project? That was just the beginning. Today, advances in genetic sequencing and editing are opening up new frontiers in healthcare. We’re talking about treatments tailored to your DNA, early disease detection, and potentially even editing out genetic diseases.

The catch? Many of these technologies are still in their early stages. Investing here requires a strong stomach for volatility and a long-term outlook.

Key Arguments for Investing in Genomics

- CRISPR gene-editing is moving from the lab to human trials, with potential to cure genetic diseases once thought untreatable.

- Liquid biopsies (blood tests that can detect multiple types of cancer early) are becoming a reality, potentially revolutionizing cancer treatment and survival rates.

- The cost of sequencing a human genome has dropped from billions to hundreds of dollars, making personalized medicine increasingly accessible.

Blockchain and Web3

Beyond the Bitcoin buzz, blockchain technology is making waves across industries. This decentralized, transparent system for recording transactions has also spun out the idea of Web3. This is a vision of a new internet where users, not tech giants, control their data and digital assets.

The big debate? Whether blockchain and Web3 will truly live up to the initial promises. Or if they’re overhyped technologies still searching for their killer app. Your take on this could guide your investments in this controversial but potentially explosive space.

Key Arguments for Investing in Blockchain

- Central Bank Digital Currencies (CBDCs) are being developed by major economies, potentially transforming global finance and monetary policy.

- Blockchain is enabling new forms of organization (DAOs) and ownership (NFTs), which could reshape how we collaborate and define property rights in the digital age.

- Smart contracts are starting to automate complex financial transactions, potentially disintermediating traditional financial services.

Space Economy

From satellite internet to space tourism, the final frontier is slowly becoming a new economic zone. Companies are racing to launch satellites, develop new propulsion technologies… and possibly even mine asteroids in the future.

The space theme is exciting, but it’s also highly speculative. Many of these ventures are still in their infancy, and the path to profitability isn’t always clear. But for those who believe in the long-term potential of space exploration and commercialization, this could be a theme to watch.

These are just a few of the major themes out there. The key is to do your own research, think critically about the potential (and limitations) of each trend, and consider how they align with your investment goals and risk tolerance.

Key Arguments for Investing in the Space Economy

- The cost of launching payloads to orbit has decreased dramatically due to reusable rockets, opening up new commercial opportunities in space.

- Satellite internet constellations are bringing high-speed internet to remote areas, potentially connecting billions of new users to the global economy.

- Advances in in-space manufacturing could lead to novel materials and products that can only be made in zero-gravity, creating entirely new industries.

Six Major Pitfalls to Avoid

Thematic investing can be exciting, but it’s not without its risks. Here, a healthy dose of skepticism and due diligence goes a long way. Some common pitfalls to watch out for include:

Chasing the Hype

Remember the dotcom bubble? Or the more recent crypto craze? It’s easy to get caught up in the excitement of a hot new theme. But popularity doesn’t always equal profitability.

The key here is to separate genuine, long-term trends from short-lived fads. Ask yourself: Is this theme solving a real problem? Does it have staying power beyond the next few years? Don’t just follow the crowd – do your own research and think critically.

Example: The 3D printing hype of 2013-2014. Companies like 3D Systems (DDD) and Stratasys (SSYS) saw their stock prices soar, with 3D Systems reaching nearly $100 per share in early 2014. However, the technology didn’t revolutionize manufacturing as quickly as some hoped. By 2015, both stocks had lost over 80% of their value.

Overlooking Fundamentals

Just because a company is in a hot sector doesn’t make it a good investment. Many investors make the mistake of buying into thematic ETFs or individual stocks without looking at the underlying financials.

Even in revolutionary industries, basic business principles still apply. Look for companies with solid balance sheets, strong management, and a clear path to profitability. A great theme won’t save a badly run business.

Example: Nikola Corporation (NKLA), the electric vehicle startup. In 2020, Nikola rode the wave of EV enthusiasm, with its stock price briefly surpassing that of Ford. However, investors who looked closely at the fundamentals might have noticed red flags:

- The company had no revenue at the time of its public listing.

- It had no functioning prototype of its flagship hydrogen truck.

- Its valuation was based almost entirely on future projections.

By September 2020, a short-seller report raised questions about Nikola’s claims, leading to a SEC investigation. The stock price plummeted from its high of about $80 in June 2020 to under $5 by early 2023.

Putting All Your Eggs in One Basket

It’s easy to get overly excited about a particular theme and go all-in. Resist this urge. Over-concentration in any single theme or sector can leave your portfolio vulnerable to major swings.

Diversification is still key, even in thematic investing. Consider spreading your investments across multiple themes, or balancing your thematic investments with more traditional holdings.

Example: The ARK Innovation ETF (ARKK) in 2020-2021. While it performed exceptionally well in 2020, rising over 150%, it then dropped by about 23% in 2021 and 67% in 2022. Investors who were too heavily concentrated in this thematic ETF saw their gains wiped out just as quickly as they came. (And all that volatility couldn’t have been good for sleep quality.)

Ignoring Timing and Valuation

Identifying a promising theme is only half the battle. Timing and valuation matter too. Some investors jump into a theme too early, before the technology or market is really ready. Others buy in too late, when valuations are already sky-high.

Pay attention to where a theme is in its lifecycle. Are you getting in on the ground floor, or has the theme already had its big run-up? And always consider whether the current price is justified by the potential future growth.

Example: The cannabis boom and bust. Many cannabis stocks, like Tilray (TLRY), saw massive price spikes in 2018 based on legalization hopes. Tilray briefly touched $300 per share in September 2018, only to fall below $3 by 2020 as initial growth expectations weren’t met.

Forgetting About Competition

When a theme takes off, competition usually isn’t far behind. Early movers in a hot sector can quickly find themselves facing off against deep-pocketed rivals or innovative upstarts.

Don’t assume that today’s market leaders will remain on top. Keep an eye on the competitive landscape and be prepared to adjust your investments as the theme evolves.

Example: GoPro (GPRO) in the action camera market. After its 2014 IPO, GoPro struggled to compete with smartphones and other camera makers. Its stock price fell from a high of about $87 in 2014 to under $5 by 2018.

Neglecting Regulatory Risks

Many cutting-edge themes operate in regulatory grey areas. From privacy concerns in AI to environmental regulations affecting climate tech, legal and policy changes can have a huge impact on thematic investments.

Stay informed about the regulatory environment surrounding your chosen themes. A single new law or court decision could make or break companies operating in these spaces.

Example: The impact of China’s tech crackdown on companies like Alibaba (BABA) and Didi (DIDI). Alibaba’s stock price nearly halved from its peak in late 2020 to mid-2021, largely due to increased regulatory scrutiny. Didi was forced to delist from the NYSE just months after its IPO due to cybersecurity concerns from Chinese regulators.

Your First Baby Steps with Thematic Investing

Like other investment strategies, thematic investing could be a full-length course. But there are some baby steps you can take right away to get the ball rolling. Here’s how to get started with this strategy:

Step 1: Pick a Theme You Believe In

Earlier, we toured a sample of the major themes investors are watching right now. After reading the major arguments for those themes, do you believe in any of them? Do any of them align with your view of the future? Which theme do you have the most interest or conviction in?

While you can certainly bet against a theme, we wouldn’t recommend it to beginners of this strategy. Betting against a theme is generally riskier (as it often involves short-selling) and is harder to implement. So to start, we’d recommend picking a theme that you genuinely believe in or would enjoy learning more about.

Step 2: Learn Enough About That Theme

The next step is simple. Learn enough about your chosen theme to be an effective investor in it. That doesn’t mean you need to learn everything, because that’s overkill. You don’t need to get a PhD in machine learning to successfully invest in AI. And you don’t need to become a physicist to spot good opportunities in quantum computing.

Instead, if your theme is technology-centric, you really only need to understand three things to get started:

- Inputs: What allows the technology to work? For example, AI needs two things: (#1) extensive processing power and (#2) a crap ton of data. Knowing this is already enough to start spotting opportunities, such as Nvidia, which builds the processor chips for AI.

- Outputs: What does the technology actually output? For example, AI models generally spit out a probabilistic decision. Under the hood, AI chatbots like ChatGPT basically string together the highest probability “tokens” for a given text prompt. Knowing this will help you separate real AI companies and the pretenders who are just hopping on the hype train.

- Sub-themes: Every theme has various sub-themes. For example, with AI, many investors are now looking for solutions to its energy problem. As AI models become more advanced, they demand gratuitous and unsustainable amounts of energy. This is both a problem for running AI on smaller devices, known as “edge AI” (another sub-theme)… as well as broader environmental concerns. Sub-themes will help you pinpoint specific investment opportunities from different angles.

If your theme is not technology-centric (e.g. the aging population, pandemic recovery, etc.), then this exercise becomes even simpler. You can basically jump to number three and focus on teasing out the various sub-themes at play.

The best themes are those you can understand and can follow in the news regularly. Make sure you know the key arguments behind them before investing, because having a concrete investment thesis is always better than just a “gut feeling” that something will do well.

Step 3: Unpack the Theme for Investment Ideas

Once you understand the basics of your chosen theme, it’s time to unpack it and find specific investments that interest you. For this step, it’s much harder to use traditional stock screeners because most of them do not have a robust way to “understand” the real themes that a stock belongs to. This is much more of an art than a science.

One way to go about this is through “outbound” research. The concept is simple: based on your learnings from Step 2, you should have an idea of the inputs, outputs, and sub-themes for your theme. Then, based on that information, you can search on Google specifically for a particular term.

For example, if you research electric vehicles and decide that solid state batteries (an emerging battery tech) is the future of EVs, try literally searching for “pure play solid state battery companies.” While not a perfect method, this is often enough for you to find the beginning of the rabbit hole. Once you find the beginning, you can go down the rabbit hole and get more in depth.

The Future is Yours: Your Thematic Investing Journey Begins

Now that you’ve got the basics of thematic investing under your belt, you’re ready to dip your toes in the water. But this is just the beginning. As you gain experience, a whole new world of advanced thematic investing techniques opens up. We’ll have in-depth guides and articles that cover these techniques in more detail. Here’s a sneak peek at what’s ahead:

- Theme Intersection: Instead of focusing on a single theme, you can identify companies at the intersection of multiple themes. For example, finding a company that’s innovating in both AI and climate tech.

- Thematic Contrarian Investing: Learn to spot themes that are undervalued or overlooked by the market. Sometimes, the most profitable themes are the ones that aren’t making headlines yet.

- Global Thematic Diversification: Expand your thematic approach globally. Different regions often lead in different themes, and understanding these nuances can open up new opportunities.

- Micro-Theme Identification: Beyond broad themes, learn to spot niche sub-themes that have potential for explosive growth.

- Theme Lifecycle Management: Themes evolve over time. Mastering the art of identifying where a theme is in its lifecycle can help you make better entry and exit decisions.

Another direction of progress, if you’re an accredited investor, is to eventually transition to pre-IPO companies. There are several marketplaces, such as EquityZen or Hiive, that allow accredited investors to buy shares in private companies. But take heed: this is a whole other can of worms, and you’ll want to tread carefully due to the lack of liquidity.

Throughout this journey, keep asking yourself: How is this theme changing the world? Which companies are best positioned to benefit? How might this theme evolve over the next 5, 10, or 20 years? Each theme you invest in is a bet on an actual vision of tomorrow. So go on – the future is yours to own.